The argument in favor of using filler text goes something like this: If you use real content in the Consulting Process, anytime you reach a review point you’ll end up reviewing and negotiating the content itself and not the design.

Contact Info

- Chicago 12, Melborne City, USA

- (111) 111-111-1111

- info@example.com

- Week Days: 09.00 to 18.00 Sunday: Closed

Social Links

What is a Tax Residency Certificate, and How to Obtain TRC in India?

Understanding what is a Tax Residency Certificate is crucial for individuals, NRIs, and businesses dealing with cross-border income. In an increasingly global economy, earning income from multiple countries is common but it often leads to double taxation. This is exactly where a Tax Residency Certificate (TRC) becomes a powerful and essential document.

A Tax Residency Certificate is an official document issued by the income tax authority of a country to confirm that an individual or entity is a tax resident of that country for a specific financial year. In India, the TRC is issued by the Income Tax Department and plays a key role in claiming tax benefits under Double Taxation Avoidance Agreements (DTAA).

What is a Tax Residency Certificate (TRC)?

A Tax Residency Certificate serves as proof that a taxpayer is legally recognized as a resident of a particular country for tax purposes. In India, individuals who qualify as Resident and Ordinarily Resident (ROR) under the Income Tax Act, 1961, are taxed on their global income income earned both in India and abroad.

In India, a person who is classified as Resident and Ordinarily Resident (ROR) must pay tax on income earned anywhere in the world. On the other hand, Non-Residents are taxed only on the income earned in India.

Sometimes, the same income may be taxed both in India and in the foreign country where it is earned. This results in double taxation.

To prevent this, India has entered into Double Taxation Avoidance Agreements (DTAA) with nearly 100 countries. To avail DTAA benefits such as reduced tax rates or exemptions taxpayers must provide a valid Tax Residency Certificate.

Why is a Tax Residency Certificate Important?

The TRC is not just a formality; it is a legal requirement to claim DTAA benefits. Without a TRC, tax authorities may deny treaty benefits, even if the taxpayer is otherwise eligible.

Key benefits include:

- Avoidance of double taxation on the same income

- Reduced withholding tax rates on foreign income

- Legal clarity on tax residency status

- Enhanced compliance with international tax laws

Both residents of India and non-residents earning income from India rely on TRCs to ensure fair taxation.

Who Can Obtain a Tax Residency Certificate?

Eligibility for a TRC depends on the residential status under the Income Tax Act, 1961:

1. Individuals (Residents of India)

Individuals classified as Resident and Ordinarily Resident (ROR) under Section 6 can apply for a TRC to claim DTAA benefits on income earned abroad.

2. Non-Resident Indians (NRIs)

NRIs cannot obtain an Indian TRC, but they must submit a TRC issued by their country of residence to claim DTAA benefits on income earned in India.

3. Businesses and Other Entities

Companies, partnerships, LLPs, and trusts with cross-border income must obtain a TRC from their country of tax residence to avoid double taxation.

Tax Residency Certificate for NRI

For NRIs, the TRC is equally important. A non-resident taxpayer can claim DTAA relief by furnishing a TRC from their resident country. This enables tax benefits on various income streams such as:

- Income from assets located abroad

- Earnings from services rendered overseas

- Salary earned outside India

- Interest from foreign savings accounts and fixed deposits

- Dividends from foreign shares and mutual funds

- Revenue from sale of agricultural products abroad

- Capital gains from the sale or transfer of foreign property

Without a TRC, DTAA benefits may be disallowed by Indian tax authorities.

Types of Income Covered Under TRC

A Tax Residency Certificate applies to a wide range of foreign-sourced income, including:

- Income from foreign assets

- Overseas service income

- Salaries earned in other countries

- Interest income from foreign bank accounts

- Dividends from international investments

- Agricultural income from foreign land

- Capital gains from overseas property transfers

This broad coverage makes the TRC indispensable for global taxpayers.

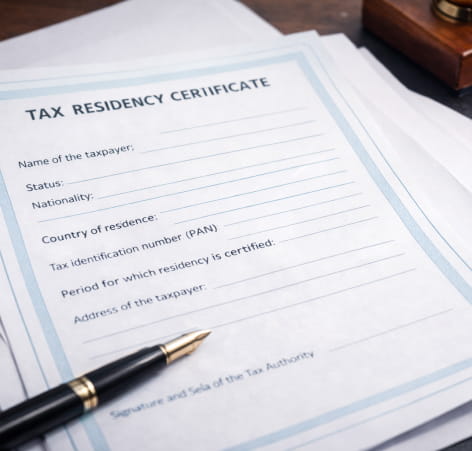

Tax Residency Certificate Format

While the format of a TRC may vary slightly by country, a typical Indian TRC generally includes:

- Name of the taxpayer

- Status (individual, company, etc.)

- Nationality (for individuals)

- Country of residence

- Tax identification number (PAN)

- Period for which residency is certified

- Address of the taxpayer

These details establish the taxpayer’s eligibility for DTAA benefits.

How to Apply for a Tax Residency Certificate in India?

The process to obtain a TRC in India is straightforward:

Step 1: Filing Form 10FA

The applicant must submit Form 10FA to the jurisdictional Assessing Officer. This form includes personal, residential, and tax-related details.

Step 2: Verification by Assessing Officer

The Income Tax Department verifies the information to confirm the applicant’s residential status.

Step 3: Issuance of Form 10FB

Upon successful verification, the Assessing Officer issues Form 10FB, which is the official Tax Residency Certificate.

The TRC is valid only for the relevant financial year, and a fresh application must be submitted each year.

Form 10F and Its Importance

Form 10F is a self-declaration form required when the foreign TRC does not contain all mandatory details prescribed under Indian tax laws. It is especially important for NRIs who:

- Do not have a PAN, or

- Have a TRC that lacks essential information

Submitting Form 10F ensures seamless DTAA benefit claims and regulatory compliance.

Conclusion

With your understanding of the Tax Residency Certificate (TRC) being clear, it is now apparent that TRC is an essential element of any strategy that involves international taxes. A TRC protects you from being double taxed on the same income whether you are a resident Indian and are earning money outside of India or if you are a Non-Resident Indian (NRI) earning money within India. With accurate documentation such as the TRC, 10FA, 10FB and 10F that a taxpayer has, they will be empowered to take advantage of the benefits available under the Double Taxation Avoidance Agreement (DTAA) in compliance with Indian tax legislation.